As cybercrime continues to rise across the fintech industry, eTranzact Ghana is stepping up its efforts to protect customers and digital assets through robust cybersecurity measures. The company’s Head of Risk and Compliance, Mr. David Sovor, shared these insights during an interview held at the company’s premises in Accra.

Mr. Sovor emphasized the importance of proactive strategies in staying ahead of online fraud. “We use our messaging systems like the in-app notifications on the XCEL mobile app to send cybersecurity warnings,” he said, referring to the company’s approach to keeping users informed. He further noted that eTranzact has monitoring tools in place to track how staff access customer databases, ensuring data security internally.

To bolster internal capacity, eTranzact Ghana regularly organizes cybersecurity training sessions for employees, facilitated by industry experts. These sessions help staff stay informed about evolving threats, particularly phishing scams and data breaches.

Combating Fraud

To combat fraud, the company also prioritize customer education through digital awareness campaigns messages that are sent via messages. eTranzact also organize staff training programs that focus on recognizing phishing scams and safeguarding sensitive data.

In addition to internal safeguards, eTranzact places high importance on customer awareness. “We prioritize customer education through digital awareness campaigns,” Mr. Sovor noted. These campaigns include informative messages sent via SMS and other digital platforms, aimed at educating users about common cyber threats and safety practices.

The company’s cybersecurity infrastructure includes comprehensive protocols such as regular system vulnerability assessments, patch management, firewalls, antivirus protection, and the use of strong cryptographic security. These efforts are guided by international standards, including ISO 27001, which governs information security management systems covering asset management, access control, and server room security.

eTranzact Ghana also adheres to PCI DSS (Payment Card Industry Data Security Standard) guidelines to ensure its card management systems are secure and capable of protecting customer data from cyber threats.

To further reinforce its commitment to security, eTranzact enforces Anti-Money Laundering (AML) protocols and maintains strict compliance with evolving regulations from the Bank of Ghana and other regulatory bodies. The company also collaborates with key stakeholders such as the Financial Intelligence Center (FIC) and the Cybersecurity Authority to implement sector-wide best practices.

Through these multi-layered efforts, eTranzact Ghana continues to position itself as a trusted and forward-thinking fintech player, committed to securing digital transactions in Ghana’s financial technology ecosystem.

Background

According to the Cyber Security Association of Ghana, the Cyber Security Authority (CSA) has expressed alarm over a sharp rise in online fraud, with financial losses surging to 4.4 million Ghana cedis in the first quarter of 2025 which is 83% increase from the 2.4 million Ghana cedis recorded in during the same period in 2024.

So far,350 cyber fraud cases have been reported as scammers increasingly exploit digital platforms to deceive unsuspecting victims. Authorities are urging the public to stay vigilant and adopt stronger cybersecurity.

How secure are our digital platforms?

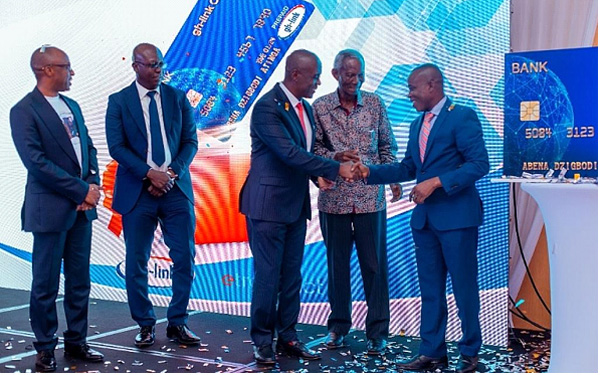

eTranzact Ghana makes digital payments simple and secure for individuals, businesses, and banks. From mobile banking and online payments to card services and bulk transactions, they also provide easy ways to send and receive money through the XCEL app which was recently launched. With a strong focus on innovation and convenience, eTranzact Ghana is helping to shape the future of digital finance here in Ghana and across the country.

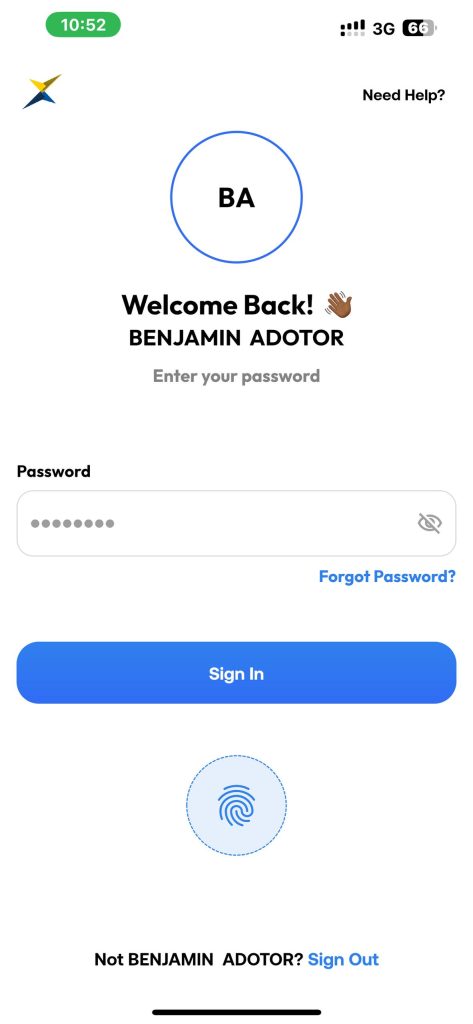

1. XCEL Ghana mobile app

eTranzact Ghana adds extra security layer, requiring both a password and a one-time code. Regular security updates are done to prevent new forms of cyberattack.

2. Payment Gateway

As a fintech company, eTranzact ensures that their payment data is securely transmitted, preventing MITM attacks. Transactions are continuously monitored for suspicious activity, allowing instant blocking of fraudulent transactions. eTranzact also uses 3D security and OTP verification in verifying transactions and reducing unauthorized payments.

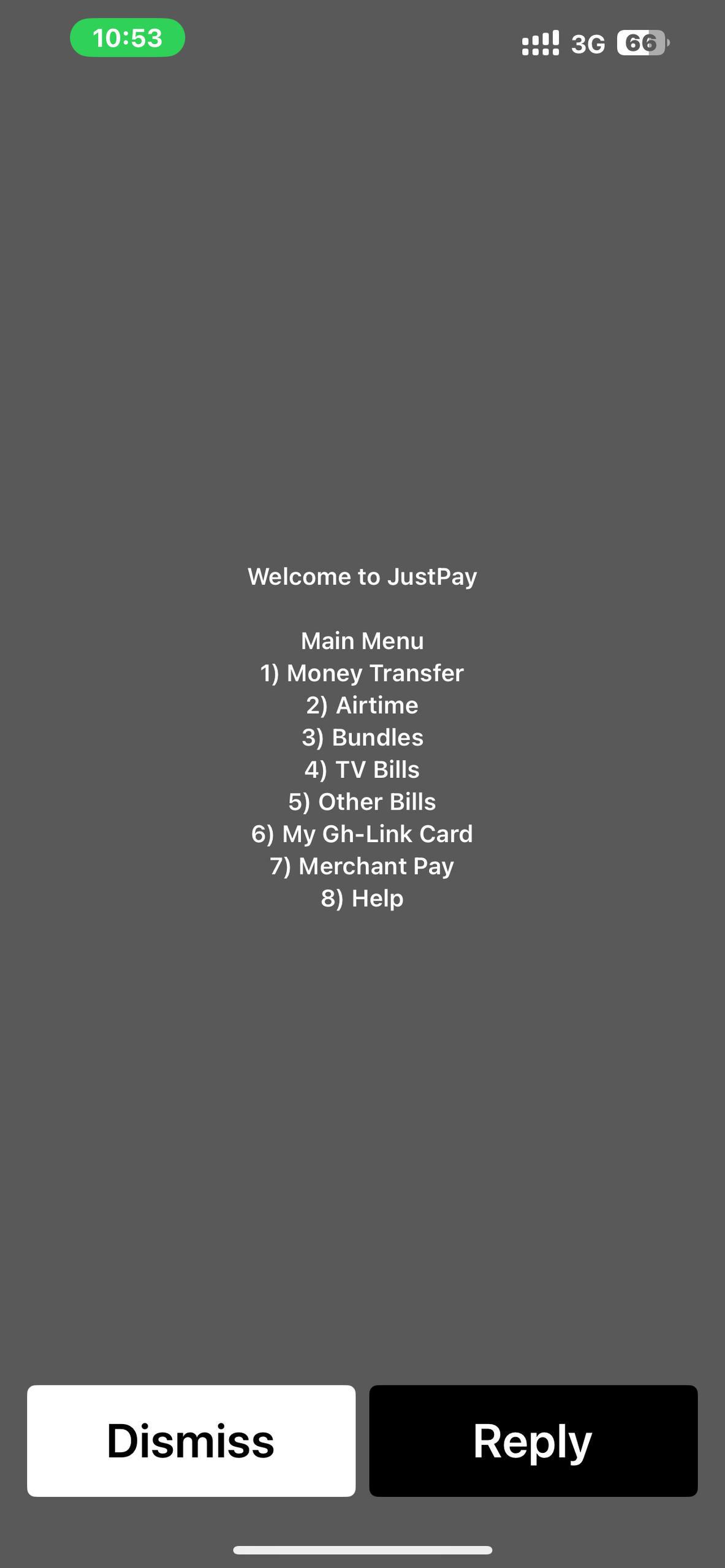

3. USSD

As a fintech company, eTranzact ensures that their payment data is securely transmitted, preventing MITM attacks. Transactions are continuously monitored for suspicious activity, allowing instant blocking of fraudulent transactions. eTranzact also uses 3D secure and OTP verification in verifying transactions with OTPs and reducing unauthorized payments.

eTranzact Ghana has been in the business of providing secure and seamless financial solutions for individuals, businesses, and financial institutions. Our services include the XCEL Ghana app, Fundgate, Agency Banking, USSD services, MerchantPay, mobile money transfers, web payments, prepaid card services, mass payment (Corporate Pay), and inward remittance services. We are committed to ensuring financial inclusion and digital transformation in Ghana’s fintech space.

For more inquiries on how to sign up for our business services, send us an email at business@etranzact.com.gh

Written by Emmanuella Sarkodie