Accra, Ghana – The Head of Digital Marketing at eTranzact Ghana, Mr. Abraham Dzagbletey, has underscored the role of user-friendly design and compelling visuals in driving adoption and engagement within the fintech industry. Speaking at a recent webinar hosted by The NewMark Group Limited, Mr. Dzagbletey highlighted how visual storytelling helps bridge the gap between complex financial products and everyday consumers.

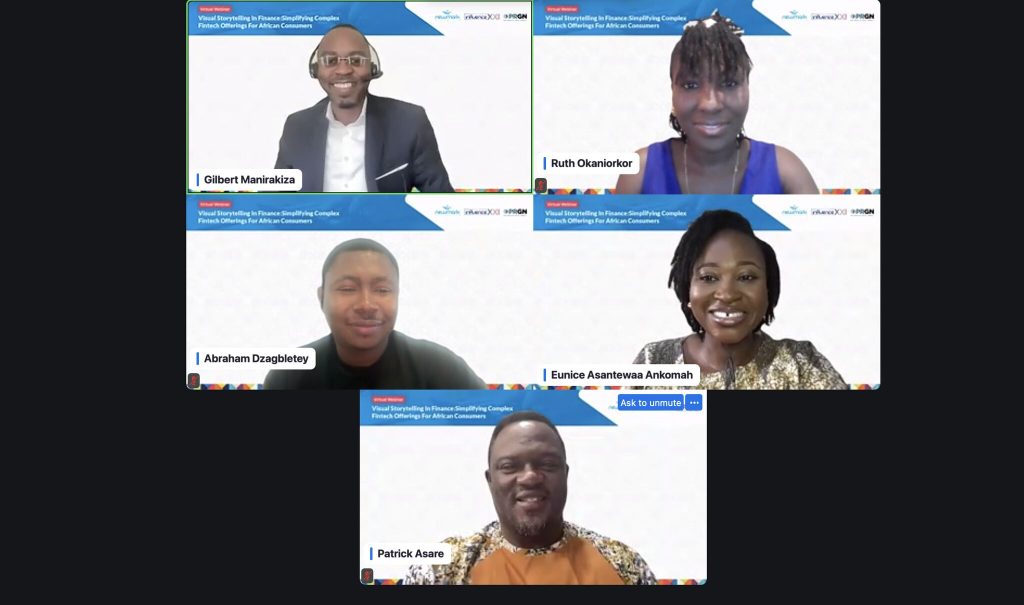

The event, themed “Visual Storytelling in Finance: Simplifying Complex Fintech Offerings for African Consumers,” brought together industry leaders to discuss strategies for enhancing fintech accessibility across the continent.

During his presentation, Mr. Dzagbletey provided a detailed overview of XCEL Ghana, eTranzact’s latest digital financial platform. He emphasized that the platform’s design focuses on simplicity and ease of use, particularly for students, who are a key target demographic.

“Our goal is to make financial services intuitive for everyone, especially students. That’s why we ensure all essential features are easily accessible from the homepage,” he explained.

The Power of Visual Storytelling in Fintech

Mr. Dzagbletey noted that effective visuals play a critical role in engaging users, particularly in the fintech space. He cited the strategic use of relatable imagery, such as students in promotional materials, to foster a sense of connection with the product.

“Visuals must communicate the message instantly. When students see themselves represented in our campaigns, they feel a connection to the product,” he added.

To enhance the efficiency and impact of fintech marketing, Mr. Dzagbletey introduced attendees to key digital tools that support visual storytelling. He highlighted:

• Canva – A design platform with AI capabilities that streamlines the creation of professional visuals.

• URL Genius – A cloud-based tool that create a unique url to direct users to specific app stores or in-app content for a seamless experience.

• Bitly – A platform for generating QR codes and tracking engagement and monitoring analytics.

“Bitly allows us to track QR code scans from both iOS and Android users, helping us optimize our campaigns,” Mr. Dzagbletey noted.

Industry Collaboration to Drive Fintech Growth

The webinar also featured insights from Gilbert Manirakiza, CEO of The NewMark Group, Eunice Asantewaa Ankomah, Fintech communications & DFS Consultant, and Patrick Asare-Frimpong, Head of Product at Hubtel Ghana. Together, the speakers explored how fintech companies can leverage storytelling and technology to simplify financial services for African consumers.

Mr. Dzagbletey’s presentation was widely praised for its practical insights and actionable strategies. Attendees commended his ability to simplify complex fintech concepts, making them more relatable and accessible.

As fintech continues to evolve in Africa, experts agree that a combination of intuitive design and compelling visuals will be essential in driving wider adoption and engagement across digital financial platforms.

Story by Benjamin Adortor